Equity dilution calculator

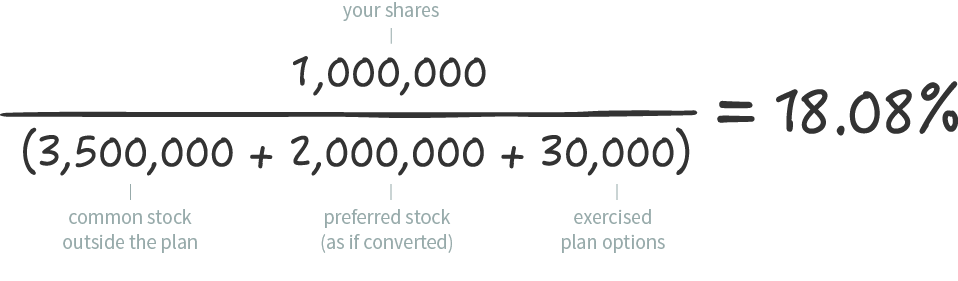

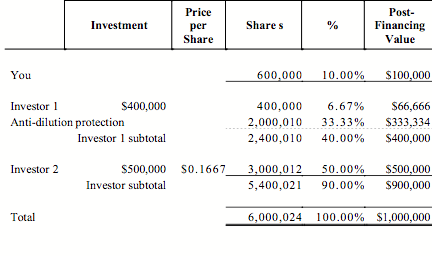

Calculator for Stock Dilution. So this is what the calculation would look like.

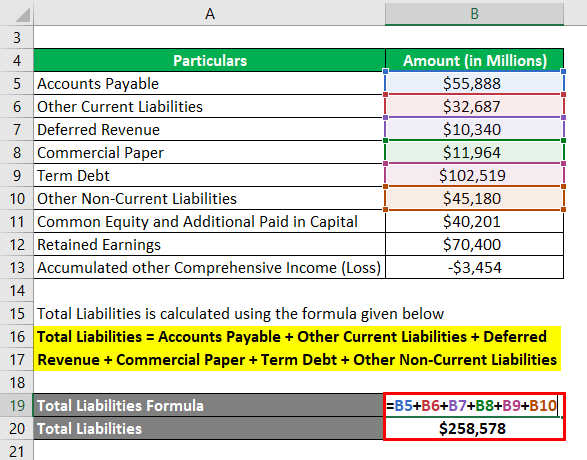

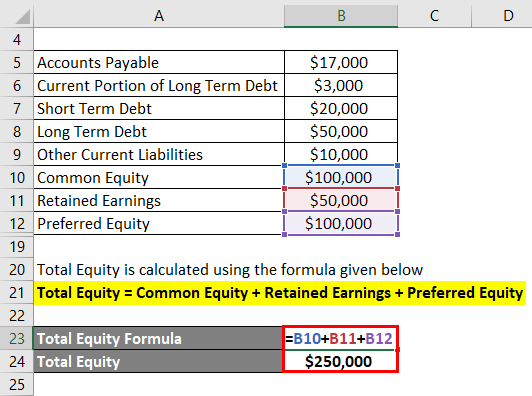

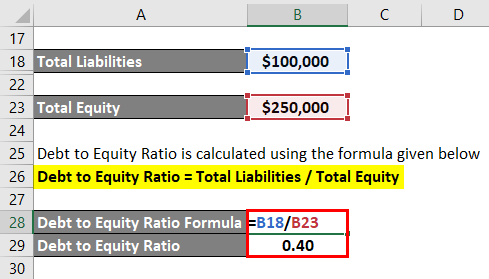

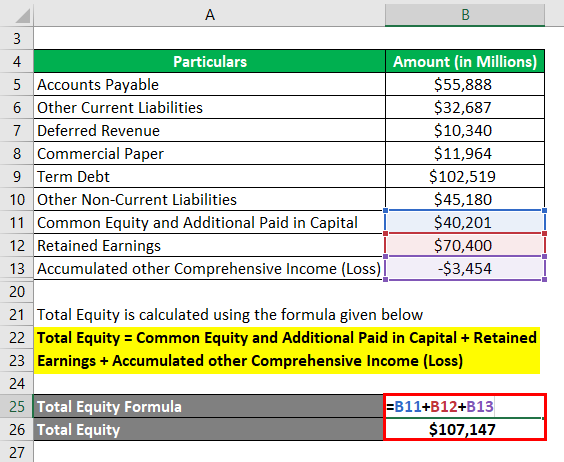

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Equity Dilution Calculator How Much Will Be Diluted In An Equity Investment Founders Workbench Last week we introduced our new Capital Calculator app and explained.

. After all of this her stake would be worth 100K 20. Updated April 24 2019 Equity dilution through the issuance of more shares could decrease the value of your stake in a company. Equity Dilution Calculator Calculating dilution from convertible notes and SAFE vehicles is quite tricky and most entrepreneurs dont know exactly how much equity theyve given up.

Most startups reserve between 10 percent and 20 percent of. Home Series A Dilution Calculator. What is Equity Dilution.

So you divide the 10 by 1 minus the series-a to arrive at 125 pre-money ESOP plus Advisor. Series A Dilution Calculator. If her equity was diluted by 20 from issuing new shares and the value of the company stayed the same her stake would be worth 400K.

Equity dilution simulator Enter the key terms for your SeedFAST Advance Subscription Agreement and understand how it will impact. They are designed to convert to equity at a later date when the value of the startup can be determined more clearly. Startup Equity Dilution Calculator Equity dilution and ownership target calculator for free.

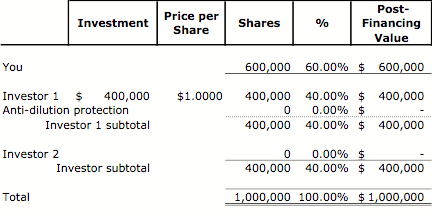

This Equity Simulator is intended to take. Simply we can calculate dilution in a cap table by subtracting the percentage of ownership before investment No. For example a founder of.

NUMBER OF OLD SHARES. The number of shares you give away in the example is 9. The conversion and valuation cap is described here.

Ownership after converting instruments to stock setting up a new stock plan and closing your new investment round. Equity Financing and Dilution Calculator Now part of The Southern Bank Company OwnYourVenture Sometimes its more than the idea. Equity dilution occurs when a founders ownership stake is reduced as a result of the issuance of new shares often following an investment.

Equity dilution in startups is defined as the decrease in equity ownership for existing shareholders that occurs when a company issues new shares. Use our equity dilution calculator to find out. Percentage of fully-diluted equity issued to A Round.

If the companys value doesnt increase after. If you give away too much to attract specific people you end up diluting yourself and your investors more than you need. Diluted Share Price PT NT PN NN NT NN Diluted Share Price 75 150000 80 100000 150000 100000 Diluted Share Price 77 per share Therefore the shareholding.

Calculate how many shares need to be issued to reach your ownership target. Common Shares Issued pre-Series A. In other words dilution.

Stock Dilution Calculator Answers the Question How much will a share of my stock be worth if new shares are issued. The post-money dilution of series-a is 20 and the ESOP is 10. To calculate this you first need to calculate the dilution coefficient.

Of outstanding shares from the percentage of ownership.

Calculating Percentage Of Ownership Hooray For New Math

Debt To Equity Ratio Formula Calculator Examples With Excel Template

The 10 Questions To Ask When Valuing Your Equity

![]()

Equity Dilution Calculator Neos Chronos

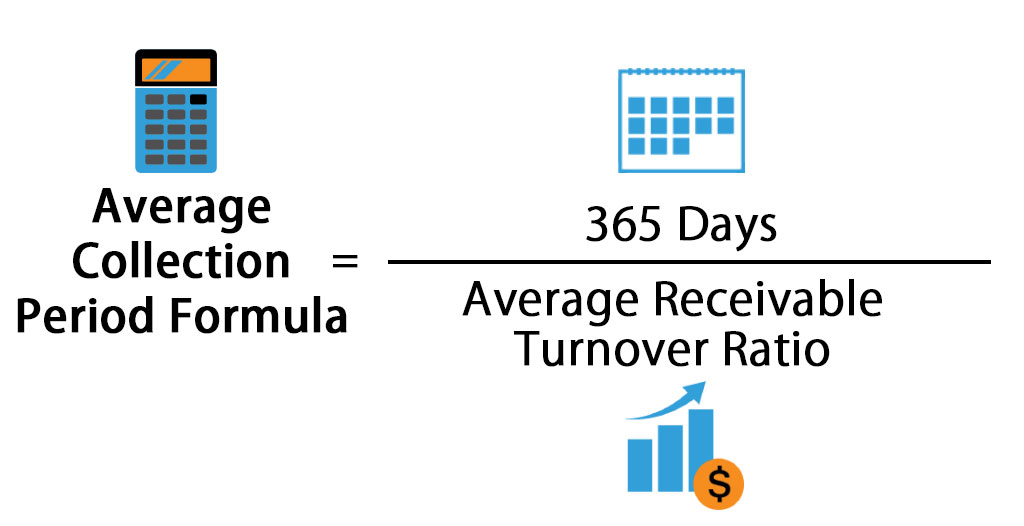

Average Collection Period Formula Calculator Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

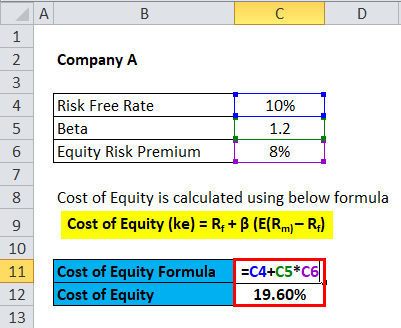

Cost Of Equity Formula Calculator Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Stock Split Formula And Google Example Calculator Excel Template

Cost Of Equity Formula Calculator Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

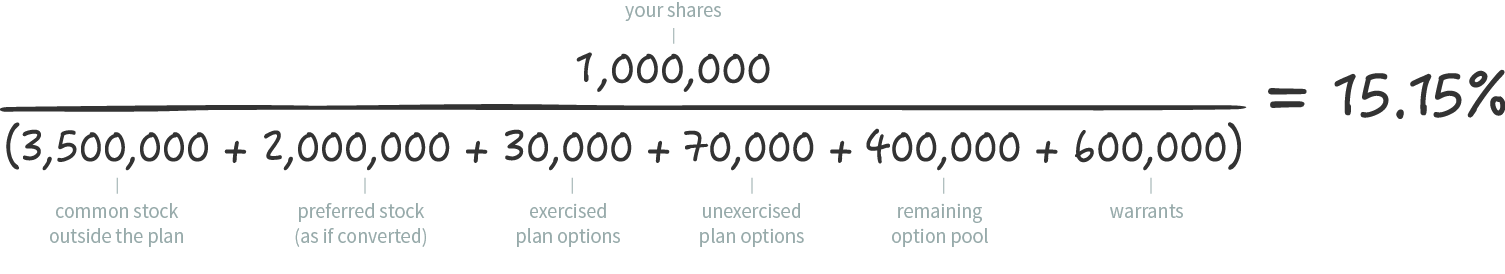

Calculating Diluted Earnings Per Share

51 Dilution

51 Dilution

Stock Split Formula And Google Example Calculator Excel Template

Calculating Percentage Of Ownership Hooray For New Math

Accretion Dilution Analysis Measuring The Impact Of An Acquisition